- Shanghai Zhongshen International Trade Co., Ltd. - Two decades of trade agency expertise.

- Service Hotline: 139 1787 2118

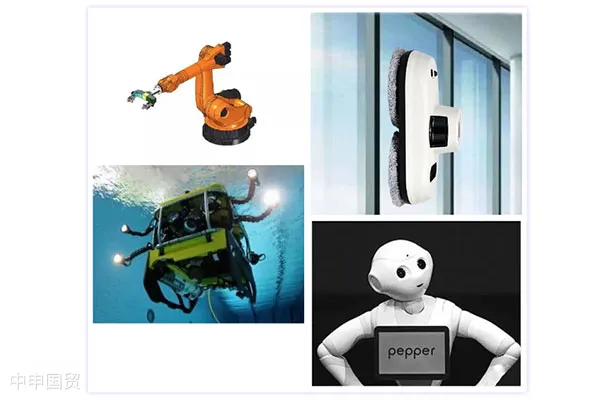

Understanding the customs classification and clearance process for robot goods. This not only relates to the smoothimport and exportbut also directly affects the costs and market competitiveness of enterprises. This article aims to explore in depth the customs classification of different types of robots and their clearance processes, providing detailed reference for relevant enterprises and individuals.

I. Customs Classification of Industrial Robots

Industrial robots can mimic human movements, featuring independent control systems and multi-purpose operating devices that replace manual operations in various industrial environments. According to the Explanatory Notes to the Harmonized System Commodity and Tariff Classification, such robots are typically classified under HS Code 84.79. More specifically, robots capable of performing different functions through simple tool changes are classified under subheading 8479.5010, while industrial robots with specific functions are classified under other relevant tariff headings such as 84.24, 84.28, or 85.15 based on their primary functions.

II. Customs Classification of Robots with Specific Functions

The classification of robots with specific functions is more detailed. For example:

Handling Robots:These robots are typically used for material handling in industrial production, such as those connected to injection molding equipment. Due to their singular handling function, they should be classified under tariff code 8428.7000.

Spraying Robots:These robots are specialized for spraying operations, such as automotive body painting. As they are solely designed for painting, they should be classified under tariff code 8424.8920.

Multi-Functional Industrial Robots:These robots can perform various functions like arc welding, handling, and cutting by changing tools. They align with the description of multi-functional industrial robots under HS Code 84.79 and should be classified under tariff code 8479.5010.

Underwater Robot Systems:Robots designed for underwater operations, such as sample collection or seabed observation, should be classified under tariff code 8479.5090 due to their independent functionality.

Classification of Robots for Non-Industrial Use

Beyond industrial robots, there are many robots designed for other purposes, and their classification is equally important:

Household Window-Cleaning Robots:These products are typically regarded as smart home appliances and, due to their specialized use, should be classified under tariff code 8509.8090.

Educational Robots:Robots used for educational purposes, such as those for programming control and sensor characteristic teaching, are usually classified under tariff code 9023.0090.

Building Block Robots:Educational intelligent programming robots for teenagers are generally classified as intellectual toys and should be classified under tariff code 9503.0060.

Summarizing the above classifications, identifying the primary function and purpose of a robot is crucial for customs classification and clearance procedures. Different types of robots are classified under different tariff codes based on their specific functional features and uses. Proper classification ensures smooth global circulation of robots and provides essential trade guidance for manufacturers and import-export businesses.

Related Recommendations

Category case

Contact Us

Email: service@sh-zhongshen.com

Related Recommendations

Contact via WeChat

? 2025. All Rights Reserved. Shanghai ICP No. 2023007705-2  PSB Record: Shanghai No.31011502009912

PSB Record: Shanghai No.31011502009912