- Shanghai Zhongshen International Trade Co., Ltd. - Two decades of trade agency expertise.

- Service Hotline: 139 1787 2118

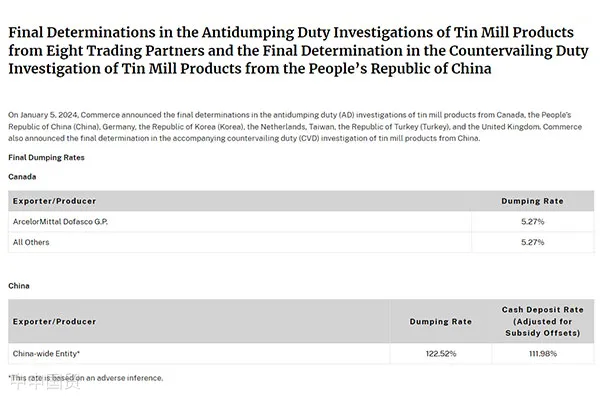

On January 5, 2024, the U.S. Department of Commerce announced a significant decision, issuing final anti-dumping rulings on tin mill products imported from Canada, China, Germany, South Korea, the Netherlands, Turkey, the UK, and Taiwan, China. This move marks new restrictions on international trade for tin mill products from the involved countries.

In the final ruling, Canadian producers/exporters faced a dumping margin of 5.27%. Chinese producers/exporters received a dumping margin of 122.52%, adjusted to 111.98% after subsidy offsets. German producers/exporters were assigned a dumping margin of 6.88%, while South Korean producers/exporters had margins ranging from 0.00% to 2.69%. Producers/exporters from the Netherlands, Turkey, the UK, and Taiwan, China were all assigned dumping margins of 0.00%.

Simultaneously, the U.S. Department of Commerce issued final countervailing duty rulings on tin mill products imported from China. In this ruling, Baoshan Iron & Steel Co., Ltd. was assigned a duty rate of 649.98%, Shougang Jingtang United Iron & Steel Co., Ltd. received a rate of 331.88%, and the nationwide uniform rate for China was set at 331.88%.

The U.S. International Trade Commission (ITC) is expected to issue final injury determinations on these anti-dumping and countervailing duty decisions by February 20, 2024. This step is the final phase of these trade measures and will determine whether they will be implemented.

The investigation for this case began on February 8, 2023, when the U.S. Department of Commerce initiated anti-dumping and countervailing duty investigations on tin mill products imported from China, and anti-dumping investigations on products from Canada, Germany, South Korea, the Netherlands, Turkey, the UK, and Taiwan, China. On June 21, 2023, the U.S. Department of Commerce issued a preliminary affirmative countervailing duty determination for Chinese imports. Subsequently, on August 17, preliminary anti-dumping determinations were made for the aforementioned countries and regions.

These final anti-dumping and countervailing duty rulings represent significant measures by the U.S. to protect domestic industries from unfair foreign competition in international trade. These decisions will not only impact the involved countries but also have far-reaching effects on the global tin mill product market.

The products involved in this case include tin mill products under U.S. Harmonized Tariff Schedule (HTS) codes 7210.11.0000, 7210.12.0000, 7210.50.0020, 7210.50.0090, 7210.50.0000, 7212.10.0000, 7212.50.0000, 7225.99.0090, and 7226.99.0180. As the investigation results are finalized, global trade participants must closely monitor the impact of these decisions on international trade dynamics.

Related Recommendations

? 2025. All Rights Reserved. Shanghai ICP No. 2023007705-2  PSB Record: Shanghai No.31011502009912

PSB Record: Shanghai No.31011502009912