- Shanghai Zhongshen International Trade Co., Ltd. - Two decades of trade agency expertise.

- Service Hotline: 139 1787 2118

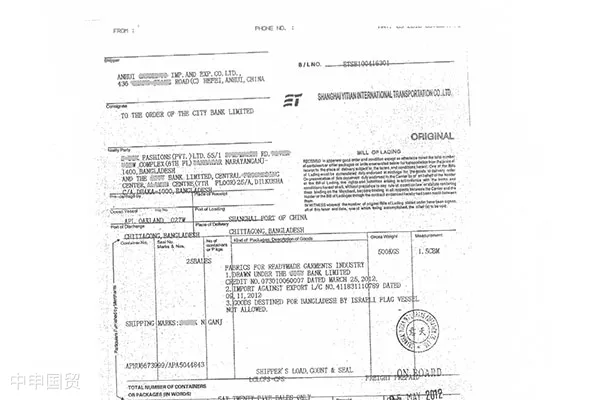

“Inforeign tradeforeign trade, payment against copy of bill of lading is a common payment method. Domestic export companies adopting this payment method often believe that if the buyer does not pay after receiving the copy of the bill of lading, they can withhold the goods to counterbalance the buyer. But is this really the case?” This is a common issue many export companies encounter in their operations. Today, China Export & Credit Insurance Corporation will use an actual claim case to explain the risks of payment against copy of bill of lading and how to effectively address these risks.

Case Introduction

Company A, primarily engaged in home apparel sales, signed a sales contract with European buyer B. The contract stipulated payment against copy of bill of lading. However, after shipment, Company A did not send the copy of the bill of lading to buyer B. Upon the goods arrival at the port, buyer B requested deferred payment due to financial difficulties. Considering the avoidance of demurrage and storage fees, Company A chose to release the goods to buyer B. Ultimately, buyer Bs sales were unsatisfactory, leading to failure in timely repayment, prompting Company A to file a claim with China Export & Credit Insurance Corporation.

Existing Issues

After investigation, China Export & Credit Insurance Corporation found the following issues in Company As operations:

Copy of bill of lading not sent: Company A failed to send the copy of the bill of lading to buyer B as agreed, which may have made it impossible to confirm the buyers payment obligation timing.

Direct release of goods without assessment: After the goods arrived at the port, Company A released the goods to buyer B without consulting China Export & Credit Insurance Corporation, affecting its insurance rights.

Failure to file a timely claim: After detecting risk signals from the buyer, Company A did not promptly file a claim or authorize recovery with China Export & Credit Insurance Corporation. By the time China Export & Credit Insurance Corporation intervened, the buyer had already gone bankrupt, adversely impacting recovery efforts.

Risk Recommendations

For businesses involving payment against copy of bill of lading, the following recommendations are provided for export companies:

Assess buyer credit: Adopt different payment terms for buyers with varying credit levels. For first-time buyers, try to agree on advance payment.

Fulfill contractual obligations and retain records: After shipment, promptly send the copy of the bill of lading to the buyer and retain written records to avoid affecting the establishment of accounts receivable.

Timely communication in case of non-payment: When facing delayed payments from the buyer, communicate promptly with China Export & Credit Insurance Corporation for detailed profit and loss analysis to seek the best solution.

Practical Operational Strategies

Utilize export credit insurance: Make good use of risk management tools like export credit insurance. In case of buyer credit risks, actively seek assistance from China Export & Credit Insurance Corporation.

Risk anticipation and control: Before signing the contract, evaluate the buyers creditworthiness, anticipate potential risks, and take corresponding control measures.

Timely and effective communication: Maintain good communication with the buyer. For payment delays or other issues, take early action to minimize potential losses.

Professional consultation: In complex or high-risk transactions, seek advice from professional trade consultants or lawyers to ensure smooth transaction processing.

Payment against copy of bill of lading, as a common foreign trade payment method, is not risk-free. Export enterprises should fully assess risks and arrange payment methods reasonably during operations. Through these measures, enterprises can not only reduce potential risks but also enhance the safety and efficiency of foreign trade transactions.

Related Recommendations

Learn

Contact Us

Email: service@sh-zhongshen.com

Related Recommendations

Contact via WeChat

? 2025. All Rights Reserved. Shanghai ICP No. 2023007705-2  PSB Record: Shanghai No.31011502009912

PSB Record: Shanghai No.31011502009912