- Shanghai Zhongshen International Trade Co., Ltd. - Two decades of trade agency expertise.

- Service Hotline: 139 1787 2118

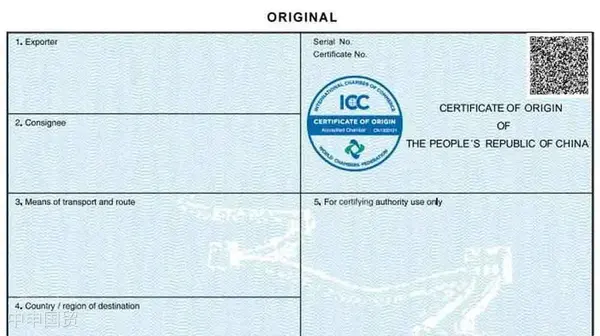

In the trade between China and Vietnam, the FORM E certificate of origin not only determines the tariff preferences but also directly affects the customs clearance efficiency. However, when a mainland company cooperates with a Hong Kong company, the filling of the “third - party invoice” becomes a key test. Once the operation is not standardized, it may face customs doubts or even the invalidation of the certificate. How to accurately fill in the FORM E and meet the special requirements of the Vietnamese customs? This article will comprehensively analyze this complex process, provide practical solutions, and enable you to calmly face the challenges of international trade.

Clarification of Roles and Logic of Information Filling

大陸主體申請(qǐng)F(tuán)ORM E

According to the provisions of the China - ASEAN Free Trade Agreement, the certificate of origin must be issued by the official agency or authorized unit of the exporting country. Therefore, the applicant of the FORM E must be a mainland company with export qualifications. The specific requirements are as follows:

- Information in Column 1: The first column of the FORM E needs to fill in the name and address of the mainland company as the official applicant.

Hong Kong Company as the Role of Third - Party Invoice

If the Hong Kong company is mainly responsible for offshore trade orA complete export agency agreement should be attached with:role, its information can appear in the relevant fields of the FORM E as a “third - party invoice”:

- Column 7 (Description of Goods): Fill in the name of the goods here and indicate the relevant information of the Hong Kong company below it.

- Column 13: The “Third Party Invoicing” option needs to be checked to indicate the existence of a third - party invoice transaction.

Concerns of Vietnamese Customers

The review standards of the Vietnamese customs for the FORM E may vary, especially for the filling methods of the “description of goods” and “third - party invoice” fields. If the information of the Hong Kong company is mixed with the description of goods or filled in irregularly, it may lead to customs clearance obstacles. Therefore, it is necessary to fully understand the specific requirements of customers and the destination port before issuing the certificate.

Common Problems and Cause Analysis

Improper Filling Position

Some enterprises, when filling in the FORM E, did not place the information of the Hong Kong company uniformly as required but mixed it into the description of goods (Column 7), which raised doubts from the Vietnamese customs. This approach may lead to the rejection of the certificate.

Inconsistent Review Standards

The acceptance and review standards of different ports in Vietnam for the FORM E vary. Some ports have special requirements for the presentation of the “third - party invoice”. Once the filling method does not meet their expectations, the certificate may be invalid.

Lack of Communication and Confirmation

If the format details are not fully communicated with the Vietnamese customers or customs clearance agents before applying for the FORM E, there will often be an “unexpected” situation in the customs clearance process, affecting the smooth entry of goods.

Feasible Solutions

Solution 1: Standardize Information Filling

The mainland company applies for the FORM E according to the correct process, places the information of the Hong Kong company uniformly below the name of the goods in Column 7, and checks “Third Party Invoicing” in Column 13. This way can clearly indicate that the origin of the goods is in mainland China, and the invoice is from the Hong Kong company.

Solution 2: Confirm Filling Details in Advance

Before formally processing the FORM E, communicate fully with the Vietnamese customers or local customs clearance agents, provide a sample of the FORM E, and confirm whether the specific format requirements and key fields meet the standards of the Vietnamese customs.

Solution 3: Adjust the Trade Model

If the Vietnamese customs insists on not recognizing the third - party invoice information, consider directly signing a contract between the mainland company and the Vietnamese customer to avoid disputes over dual - headings. In addition, when necessary, evaluate the use of other trade methods or certificates of origin to ensure the realization of tariff preferences.

Core Precautions

Ensure the Actual Origin of Goods

The prerequisite for the application of FORM E is that the goods must be completely produced in the Chinese mainland or have undergone sufficient value - added processing in the mainland. Enterprises must ensure that the rules of origin comply with the requirements of the agreement.

Consistency of Document Information

All documents such as contracts, invoices, packing lists, and customs declarations must be consistent with each other to avoid affecting the validity of the certificate due to information conflicts or incompleteness.

Pay Attention to Local Implementation Differences

The actual implementation details may vary at different ports in Vietnam. It is recommended that enterprises adjust their filling strategies based on the actual situation of the specific destination to ensure smooth customs clearance.

Conclusion

The Certificate of Origin (FORM E) is an important tool in Sino - Vietnamese trade. As long as enterprises strictly abide by the rules during the filling process and maintain full communication with Vietnamese customers, the cooperation model between mainland companies and Hong Kong companies can fully achieve tariff preferences and smooth trade. At the same time, enterprises need to respect the different needs of each port to flexibly respond to the changing international trade environment.

Related Recommendations

? 2025. All Rights Reserved. 滬ICP備2023007705號(hào)-2  PSB Record: Shanghai No.31011502009912

PSB Record: Shanghai No.31011502009912