- Shanghai Zhongshen International Trade Co., Ltd. - Two decades of trade agency expertise.

- Service Hotline: 139 1787 2118

The retention and storage of export goods filing documents is an important part of international trade, especially crucial for enterprises that hope to apply for export tax rebate (exemption). With the development of technology, the storage methods have become diversified and are no longer limited to traditional paper storage. The following details the storage methods, storage time limits, zero - tax rate situations, consequences of non - compliance, types of filing documents, and relevant policy guidelines of the filing documents.

I. Storage Methods

Diversified storage methods

Modern storage methods for filing documents include paper - based, imaging, or digital. Enterprises can choose suitable storage methods according to their own needs.

Special requirements for paper - based filing documents

If choosing the paper - based storage method, the enterprise needs to specify the storage location in the export tax rebate (exemption) filing document catalog. If the tax authorities need to inspect the imaging or digital filing documents, the enterprise needs to convert them into paper - based form, and affix the enterprise seal and sign a statement.

II. Storage Time Limits

The sorting and retention time limit of filing documents

Within 15 days after applying for export tax rebate (exemption), the enterprise should sort out the filing documents and create a filing document catalog in chronological order.

Retention period

All filing documents must be properly stored and not be damaged without permission. The retention period is 5 years.

III. Zero - tax Rate Situations

Zero - tax - rate cross - border activities are not subject to filing document management: Taxpayers who conduct zero - tax - rate cross - border taxable activities do not need to follow the filing document management regulations.

IV. Consequences of Non - compliance

Loss of tax rebate (exemption) application qualification: Export goods that have not been filed with documents as required cannot apply for tax rebate (exemption). If they have been declared, a negative declaration must be used to offset the original declaration.

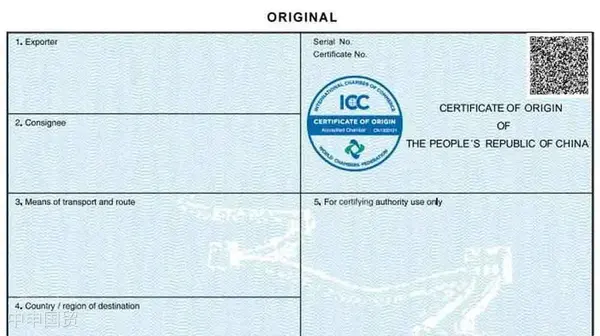

V. Types of Filing Documents

Purchase and sales contracts of export enterprises

Including export contracts,foreign tradecomprehensive service contracts, etc.

Transport documents of export goods

IncludingMaritime Transportationbills of lading, airwayAir Transportationbills, railway bills of lading, etc.

Documents for entrusted customs declaration

Including entrusted customs declaration agreements, agency customs declaration service fee invoices, etc.

VI. Policy Guidelines

Announcements of the State Taxation Administration

Including Announcement No. 9 in 2022, Announcement No. 12 in 2013, etc., which provide specific policy guidelines for enterprises.

Policy interpretation

Enterprises should pay close attention to the latest announcements and policy interpretations of the State Taxation Administration to ensure compliant operations.

The correct retention and storage of export goods filing documents is crucial for enterprises export tax rebate (exemption) applications. Enterprises should choose suitable storage methods according to their own situations and ensure compliance with relevant policy regulations to avoid unnecessary troubles and losses.

Related Recommendations

? 2025. All Rights Reserved. Shanghai ICP No. 2023007705-2  PSB Record: Shanghai No.31011502009912

PSB Record: Shanghai No.31011502009912