- Shanghai Zhongshen International Trade Co., Ltd. - Two decades of trade agency expertise.

- Service Hotline: 139 1787 2118

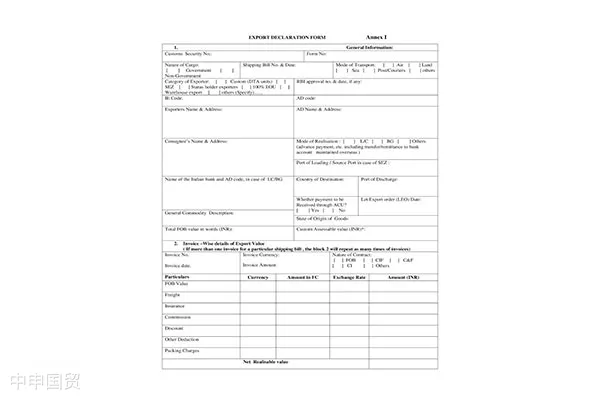

Enterprises must comply with the following legal documents whenExport Clearancesubmitting declarations: Customs Statistics Regulations of the Peoples Republic of China, Implementation Regulations of the Peoples Republic of China on Customs Administrative Penalties, Administrative Measures for the Amendment and Cancellation of Customs Declarations for Import and Export Goods of the Peoples Republic of China, Customs Declaration Form Filling Standards for Import and Export Goods of the Peoples Republic of China, and Procedural Regulations for Handling Administrative Penalty Cases by the Customs of the Peoples Republic of China.import and exportCommon error cases in export customs declaration

Export customs declaration is a critical step for export enterprises. However, in practice, declaration errors often lead to amendments or cancellations, wasting resources and potentially affecting shipping schedules. Based on relevant legal documents, this article analyzes common errors in export customs declarations, including price and currency, gross and net weight, quantity and unit, final destination country, and duty exemption methods.

Price and currency

Decimal point errors in total price: Enterprises may misplace the decimal point when declaring the total price. For example, $54,643.68 might be mistakenly declared as $5,464,368. Such errors can significantly impact tax calculations and statistical accuracy.

Extra digit in total price: This error occurs when an additional digit is added, such as declaring $24,248 as $248,248. It may lead to overcalculation of taxes, causing unnecessary financial losses.

Incorrect currency declaration: Enterprises may select the wrong currency, such as declaring USD transactions in CNY. This can result in tax calculation errors or inaccurate statistics.

To avoid these errors, enterprises must carefully verify the total price and currency during declaration. Regular reviews and optimization of declaration processes can also reduce error likelihood.

Gross and net weight

Logical errors: These involve miscalculations of gross and net weight. For example, the total weight (gross or net) of a single item may not match the total weight listed in the declaration header due to calculation, entry errors, or misunderstanding of weight definitions.

Swapped gross and net weight: A common error where enterprises mix up the positions of gross and net weight. For instance, net weight might be entered in the gross weight field, and vice versa, causing issues for tax calculations and customs oversight.

To prevent such errors, enterprises must clearly understand the definitions of gross and net weight and their correct positions in the declaration form. Gross weight includes the product and packaging, while net weight refers only to the product itself. Accurate entry in the correct fields is essential.

Quantity and unit

Mismatched units between declared and actual quantities: For example, an enterprise may declare goods in sets on the customs form but list them as pieces on the VAT invoice. Inconsistent units between documents can lead to

Inconsistent units of declared transaction quantity and actual product quantity: For example, a company declared the unit of goods quantity as set in the customs declaration, but the same products quantity unit in the subsequent VAT invoice was piece. Due to the inconsistency in quantity units between the customs declaration and VAT invoice, it may lead toExport DrawbackBlocked.

Failure to declare the statutory primary and secondary units in accordance with the provisions of the Statistical Commodity Directory of the Peoples Republic of China: For example, when filling in quantities and units, enterprises may overlook or misunderstand the regulations on statutory primary measurement units and statutory secondary measurement units in the Statistical Commodity Directory of the Peoples Republic of China, leading to declaration errors.

To avoid such errors, enterprises must ensure strict compliance with the provisions of the Filling Specifications for Customs Declaration Forms for Import and Export Goods of the Peoples Republic of China when reporting quantities and units. Specifically, the first line for statistical quantities should be filled in according to the statutory primary measurement unit of the goods, with the statutory measurement unit based on the Statistical Commodity Directory of the Peoples Republic of China. For goods with a statutory secondary measurement unit specified, the second line should report the quantity and unit according to the statutory secondary measurement unit. If there is no statutory secondary measurement unit, the second line should be left blank. The transaction measurement unit and quantity should be reported in the third line.

Final destination country

A common error is reporting China (142) as the final destination country under general trade terms, which is clearly a logical error.

To avoid such errors, enterprises must select the correct country (region) name and code for the final destination country (region) based on actual circumstances and ensure it aligns with the trade terms.

Duty exemption method

Incorrect logical correspondence between the supervision method and duty exemption method: For example, an enterprise declares the supervision method as processing trade but leaves the record number blank, which is logically inconsistent. In reality, the enterprises supervision method should be general trade.,

An enterprise declares the supervision method as bonded warehouse goods but reports the duty exemption method as duty levied (Customs code 1). In reality, the enterprises duty exemption method should be full exemption (Customs code 3).

In cases of non-direct return and where taxes have already been deducted, reporting the duty exemption nature as full exemption (Customs code 3) is incorrect if the conditions for exemption are not met. The correct method should be duty levied (Customs code 1).

To avoid these errors, enterprises must select the correct duty reduction or exemption method based on actual circumstances and ensure it aligns with the supervision method.

The above content is sourced from the customs.ZhongShen International TradeAs a one - stop importExport RepresentationService providers can provide customized import and export solutions for various industries. If you needforeign tradeFor import and export agency services, please feel free to contact our company for business inquiries. The consultation hotline is 139 - 1787 - 2118.

Related Recommendations

? 2025. All Rights Reserved. Shanghai ICP No. 2023007705-2  PSB Record: Shanghai No.31011502009912

PSB Record: Shanghai No.31011502009912