- Shanghai Zhongshen International Trade Co., Ltd. - Two decades of trade agency expertise.

- Service Hotline: 139 1787 2118

On December 31, 2024, based on the applications submitted by Vitro Flat Glass, LLC and Vitro Meadville Flat Glass, LLC of the United States on November 21, 2024, the US Department of Commerce announced the initiation of anti - dumping and counter - vailing investigations on float glass products imported from China and Malaysia. The products involved in this investigation mainly include glass plates, glass sheets and other types of float glass products, covering the following US customs codes: 7005.10.8000, 7005.21.1010, 7005.21.1030, 7005.21.2000, 7005.29.1810, 7005.29.1850, 7005.29.2500, 7007.29.0000, 7008.00.0000, 7009.91.5010, 7009.91.5095 and 7009.92.5010.

Investigation background and the amount involved

According to US statistical data, in 2023, the value of the products involved imported by the US from China was approximately $140 million, and from Malaysia was approximately $7.06 million. These float glass products are widely used in the construction, automotive andphotovoltaicindustries, with a relatively large market scale and being relatively sensitive to prices.

Vitro Flat Glass, LLC and Vitro Meadville Flat Glass, LLC believe that float glass products from China and Malaysia are being dumped in the U.S. market at prices below normal value and have received unfair government subsidies, causing substantial injury or threat of injury to the domestic industry. Therefore, the two companies have submitted an application to the U.S. Department of Commerce under the Tariff Act of 1930, requesting the initiation of anti-dumping and countervailing investigations.

Main investigation process and time nodes

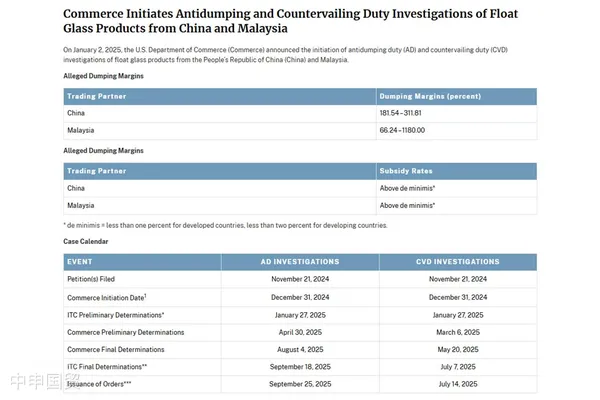

According to the procedural arrangements of the US Department of Commerce and the International Trade Commission (ITC), the investigation of this case mainly includes the following key time nodes:

- Preliminary industry injury ruling

The US International Trade Commission (ITC) is expected to make a preliminary anti - dumping and counter - vailing industry injury ruling no later thanJanuary 27, 2025. If the ITC rules that the imported products do cause material injury or threat of material injury to the US domestic industry, the US Department of Commerce will continue the investigation. - Preliminary counter - vailing ruling

The US Department of Commerce is expected to release the preliminary results of the counter - vailing investigation onMarch 6, 2025. If government subsidy behavior is confirmed, the subsidy rate and countermeasures will be further determined. - Preliminary anti - dumping ruling

The US Department of Commerce is expected to make the preliminary results of the anti - dumping investigation onApril 30, 2025. If the dumping behavior is established, the preliminary anti - dumping duty rate will be determined. - Final ruling

After the preliminary ruling, the Department of Commerce will continue to conduct further investigations and make a final ruling a few months later. If the ruling is established, final anti - dumping and counter - vailing duties will be imposed on the relevant products.

Involved tax rates and subsequent impacts

If the preliminary and final rulings confirm the existence of dumping and subsidy behaviors, the US Department of Commerce will impose anti - dumping and counter - vailing duties according to the specific situation. The level of the tax rate will be determined based on the following factors:

- Dumping Margin

The calculation of the dumping margin is based on the difference between the export price of the涉案產(chǎn)品 and its normal value (domestic market price or reasonable substitute value). It is preliminarily expected that the dumping margins for Chinese and Malaysian enterprises will vary due to individual differences among enterprises. - Subsidy Margin

The subsidy margin is determined by the amount of government support and subsidies received by the enterprise. In previous investigations of similar products, the subsidy margins of Chinese exporters were generally between 10% and 25%.

Original Announcement:https://www.trade.gov/initiation-ad-and-cvd-investigations-float-glass-products-china-and-malaysia

Related Recommendations

? 2025. All Rights Reserved. 滬ICP備2023007705號(hào)-2  PSB Record: Shanghai No.31011502009912

PSB Record: Shanghai No.31011502009912