- Shanghai Zhongshen International Trade Co., Ltd. - Two decades of trade agency expertise.

- Service Hotline: 139 1787 2118

What exactly is EORI?

EORI, which sounds like an elite club code, actually stands for Economic Operator Registration and Identification. Simply put, its a system used within the European Union to identify and register cross-border trade participants. Imagine it as your VIP card that makes trade between EU countries smoother.

How to obtain this VIP card in France?

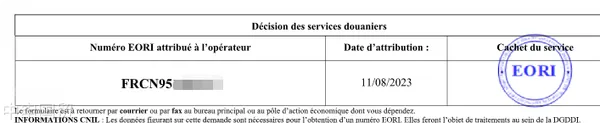

If you engage in cross-border trade in France, congratulations, you need this VIP card. To obtain it, simply submit an application to French Customs or the relevant government agency and wait patiently. Once obtained, this number will be your unique identity for cross-border trade in France.

The EORI number is valid throughout the EU, so if you plan to do business in other EU countries, remember to apply for an EORI number there as well, or simply use the same EORI number across the entire EU.

The latest developments of French EORI

New regulations are about to take effect!

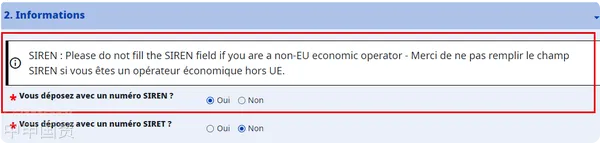

Starting fromNovember 20, 2023Starting from [DATE], the French customs will deactivate the EORI numbers associated with invalid SIREN/SIRET. This means that if your SIREN number becomes invalid, your EORI number will also become invalid.

What is the relationship between EORI and SIREN/SIRET?

The SIREN number is a 9-digit identifier assigned by the French National Institute of Statistics and Economic Studies to each registered business. The SIRET number includes the SIREN number plus an additional 5-digit code representing the businesss specific location. Simply put, SIREN is the businesss ID number, while SIRET is the businesss detailed address.

New Customs Clearance Service DELTA IE to be Launched!

This is a new service from French Customs, scheduled to launch in September 2023 in the new DELTA IEImport Clearancesystem. The service is expected to be available until 2025.

What are the impacts under the new French EORI regulations?

Only a valid SIREN number can be used to apply for a French EORI, and successful applications can only be made once.

Operators without a French tax number will be unable to apply for an EORI, even if they possess tax numbers from other EU countries.

If the SIREN number becomes invalid, the associated EORI number will simultaneously become invalid.

Finally, is EORI the same as VAT?

No, they are two completely different concepts. Simply put, VAT is a tax identification number for each country, while EORI is an EU-wideimport and exportregistration number. So, dont confuse them!

Related Recommendations

? 2025. All Rights Reserved. Shanghai ICP No. 2023007705-2  PSB Record: Shanghai No.31011502009912

PSB Record: Shanghai No.31011502009912